After two decades of onboarding brands that have left larger providers, we hear the same story. The 3PL that won the contract with promises of scale, technology, and national reach turns out to be a poor fit for the complexity that defines modern brand fulfillment. The decision to leave is rarely about one bad quarter—it is about recognizing that the mismatch between the provider's model and the brand's needs is structural.

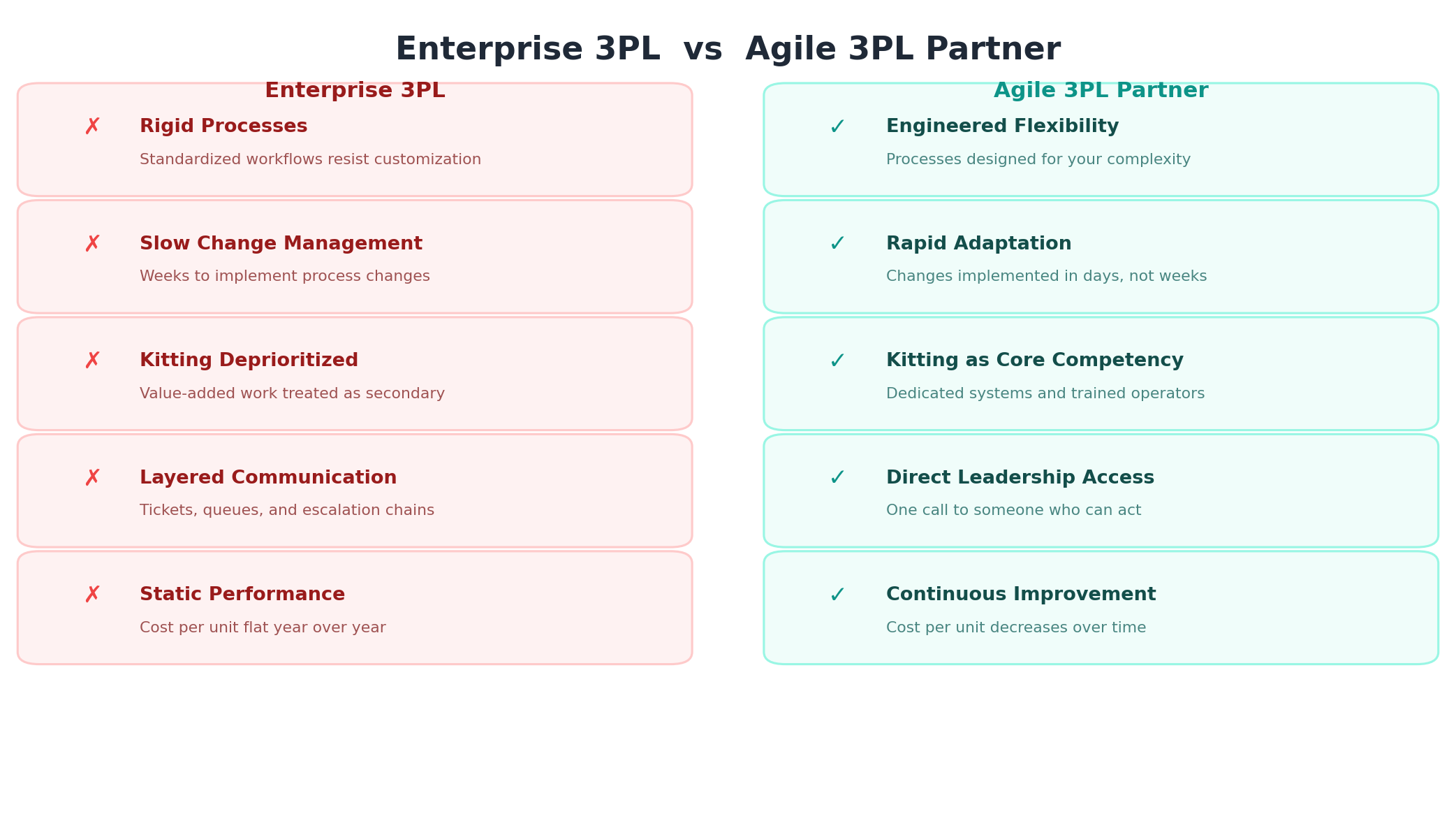

This is not a story about bad companies. Enterprise 3PLs are built for enterprise problems—high-volume, low-variation, predictable throughput. They excel at storing pallets and shipping cases. But if your business involves kitting and assembly, seasonal promotions, subscription variability, or retail display builds, you are asking a machine built for simplicity to handle complexity. And that is where the relationship breaks down.

We have seen this pattern play out many times. A consumer goods company consolidates its operation with us after needing to split fulfillment across two providers just to handle hand packaging requirements while hitting OTIF SLAs. A medical device manufacturer shifts work to Productiv after their facility shuts down and they need a partner that can maintain quality standards without missing a beat. A seasonal company needs a provider that can ramp from near-zero to full capacity on short notice and finds that their current 3PL's model was not built for that kind of variability.

If you are experiencing friction with your current 3PL and wondering whether switching is worth the disruption, this guide walks through the most common reasons brands leave, the signals that it's time to move, what to look for in a replacement, and how to manage the transition without disrupting your supply chain.

The Five Reasons Brands Leave Enterprise 3PLs

The same five patterns emerge in nearly every conversation we have with brands that have outgrown a larger provider. These are not the result of one bad shipment or one bad quarter—they are symptoms of a structural mismatch between how the provider's model works and what the brand actually needs.

1. Rigidity in the Face of Complexity

Large 3PLs run on standardized processes. That standardization is what allows them to operate at massive scale—but it is also what limits their flexibility when confronted with non-standard work. A brand that needs monthly kit configuration changes, variable subscription box builds, or promotional packaging with short production windows is asking the 3PL to deviate from its optimized workflow. The result is slow change management, missed deadlines, and a general resistance to anything that does not fit the standard operating procedure.

We see this regularly with high-growth seasonal companies. Buzzy Seeds, for example, operates on concentrated demand cycles—large retailers placing orders on short timelines, volume scaling rapidly during peak windows. For companies with that kind of variability, finding a provider that can flex with the demand rather than resist it is often the deciding factor. When we onboarded Buzzy Seeds, we mapped out their seasonal production flows and designed a system that accommodates the surges rather than breaking under them.

We get a lot of requests from large retailers. Productiv's willingness to accommodate work from us and have awesome communication is really what makes them a head above other people we've talked to.

For asset-light consumer brands—companies with lean headquarters teams that outsource manufacturing and rely on their 3PL as an extension of operations—this rigidity is not a minor inconvenience. It is an existential constraint on how fast they can launch new products, respond to retail opportunities, and execute the promotional programs that drive revenue.

2. Kitting and Value-Added Services Get Deprioritized

Enterprise 3PLs are optimized for storage and transportation—their core competency. Kitting, assembly, display builds, and custom packaging are lower-margin, higher-complexity work that requires dedicated labor, process engineering, and quality controls. When warehouse capacity gets tight or labor is constrained, the value-added work is the first thing that slips.

We took on a medical device manufacturer's custom surgical procedure tray kitting when a competitor recall created a short window to capture market share. The client needed surge capacity, but didn't have the time to ramp up hiring full-time employees. We started with a single surge production line, exceeded their throughput and quality metrics, and were given additional steady-state lines. Over time, we worked with the client to identify how picking accuracy was causing downtime—a problem that wasn't visible until we started capturing, measuring, and analyzing throughput and downtime. That relationship expanded from surge kitting to warehouse operations because the work was treated as a core competency, not an afterthought.

A similar pattern played out with a national cosmetics brand. Their secondary supplier had fill capacity but not packaging capacity, and staffing agencies were causing absenteeism, missed targets, and cost overruns. Over 175,000 pieces were backed up post-fill. We received a call on a Friday afternoon and had equipment installed and two production lines running by Monday. Within six months, output went from 5,000 to over 25,000 units per shift across 27 production lines. The client eventually moved their entire hand packaging department to us and now uses our performance data to set annual production standards in their ERP system.

Brands that depend on kitting as a core part of their fulfillment—subscription companies, beauty brands creating gift sets, CPG companies building retail displays—need a provider that treats this work as the main event, not a side project that gets bumped when simpler work takes priority.

3. Communication Requires Constant Escalation

At a large 3PL, your primary contact is typically an account manager who sits between you and the people actually doing the work. Getting answers requires escalation. Getting changes implemented requires multiple approvals. Getting time with someone who can make decisions often takes longer than the problem can afford.

This is one of the most consistent reasons brands come to Productiv. John Toler, CEO of Evergreen Enterprises—a national retailer with omnichannel distribution including their own retail stores—put it directly:

I have direct access to the key decision-makers, Paul and Doug, and they make decisions quickly. There's not a lot of hierarchy in the organization, so if we need something done, a 10-minute phone call is all it takes. We don't have to wait for approvals from senior leadership like an SVP or president—that makes a huge difference.

In John's experience, the larger 3PLs are less flexible with longer contracts and longer engagements. He had worked with smaller providers too, but they did not offer the suite of services or the geographic reach his business required. That gap—national reach and enterprise-level capability, but where a 10-minute call to the people running the company actually gets things done—is what led him to Productiv.

Brands with lean operations teams—often just a Head of Operations plus a small support staff—cannot afford to spend their time managing their 3PL. When every request becomes a ticket in a queue, the relationship becomes transactional rather than strategic, and the brand loses the responsiveness it needs to compete.

4. Seasonal and Promotional Surges Expose Fragility

The scale of the labor challenge is significant: 47% of 3PLs report labor shortages and nearly 60% of warehouses operate at over 90% capacity. Under those conditions, surge volume does not get absorbed—it creates failures.

This is where the structural gap between enterprise 3PLs and purpose-built operations becomes most visible. When a national cosmetics brand shifted volume overnight to a secondary supplier that had fill capacity but not packaging capacity, we mobilized over a weekend—installing conveyor belts and sealing equipment in the client's conference room—and had two production lines of 12 people each running by Monday at a fixed unit cost. Within the first month, we reduced the client's hand packaging from two shifts to one shift while increasing output. By month six, we were running 25,000+ units per shift across 27 lines.

The ability to flex is not just about peak season. It is about structural readiness. Joerg at Sonopress, a manufacturing partner, described the challenge directly:

We need a lot of flexibility in our business. There are times when we need 100–150 people and then there are also days when we have no work.

In their first year of working with Productiv, Sonopress won a new account that increased their business fivefold—growth that was only possible because we could ramp with one to two days of lead time. At Merit Medical, we helped their Richmond facility cut overtime to zero while providing the ability to pull resources for as short as three days at a time for surge capacity, recalls, and market disruptions.

Productiv has always done a really good job. They get people to come in and say we're going to knock this out, we're here to work and we make more money if we work more efficiently.

For companies that run seasonal projects or manage subscription box programs with monthly variability, this is not an edge case. It is the operating reality, and a 3PL that cannot flex reliably is a liability. The COVID pandemic made this painfully clear: when elective medical procedures paused, one of our surgical kitting clients was able to cut costs faster than their competitors because we flexed labor down and moved workers to other sites. Their competitors with permanent employees simply could not adapt at the same speed.

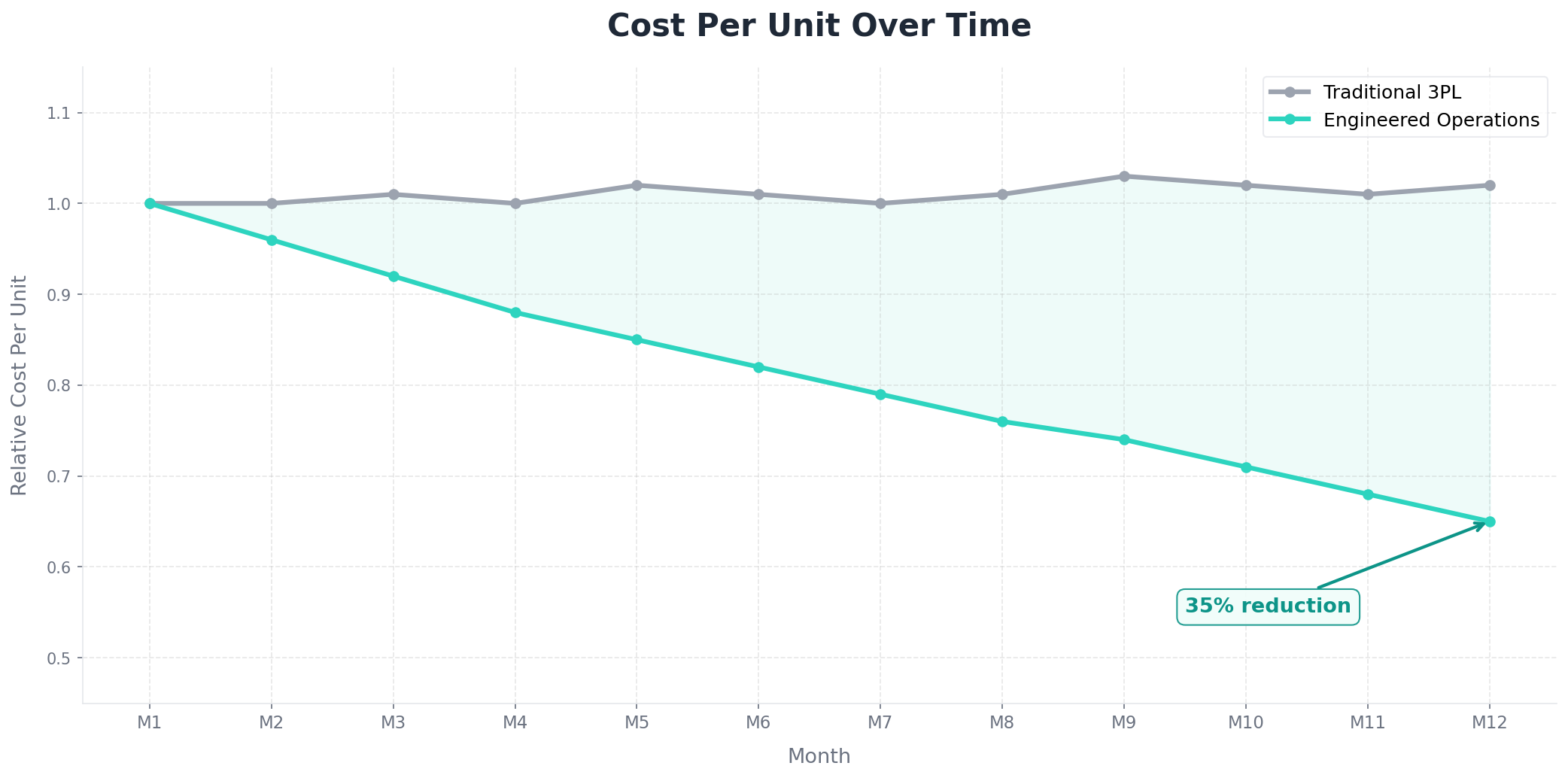

5. Performance Is Static—Costs Never Decrease

Perhaps the least visible problem is the absence of continuous improvement. Year one looks like year three. The cost per unit does not decline. Error rates plateau rather than decrease. Throughput does not improve. The 3PL's model is built around standardized processes applied across hundreds of clients—which is what makes their scale possible. The trade-off is that there is less room to invest in optimizing any individual operation.

At Productiv, our fixed unit cost pricing model deliberately aligns incentives differently: we earn more when we work more efficiently. That creates a built-in motivation to engineer improvements into every operation, not just maintain the status quo. The results show up in the numbers.

Pourri, a consumer goods brand, worked with us for two years and saw consistent, compounding gains. Their EVP of Operations, Kelli Overson, described where the relationship stands now:

We are hitting all the SLAs over and over again. Productiv has led the charge and brought so many improvements to the table over the last two years. There's nothing glaring that stands out anymore and now we are just fine tuning.

At Fareva, a global manufacturer, we ran an experiment: we took a shift that was underperforming from a people perspective and assembled a dedicated crew focused on discipline, understanding the rules of the building, and knowing the job on the floor. The result was a 10-point efficiency uptick from operational structure alone—no new equipment, no new technology, just engineered management of the workforce.

We had a shift that was inefficient from a people perspective. We got together with Productiv and put a crew together as an experiment focused around discipline, the rules in the building, and understanding the job on the floor. With just that, we had a 10 point uptick in efficiency.

For a brand paying for contract packaging, kitting, and DTC fulfillment, static performance is a compounding cost. Every quarter without improvement is a quarter where you are overpaying relative to what an optimized operation could deliver.

The Signals That It's Time to Switch

The 2025 Third-Party Logistics Study found that shipper satisfaction with 3PL relationships has dropped to 89%—down from 95% the prior year—signaling that more brands are reaching their breaking point. The question is whether the friction you are experiencing is fixable or structural.

Not every frustration with a 3PL warrants a switch. Transitions are disruptive and carry real risk. But there are clear signals that the problems are structural rather than circumstantial—and that no amount of escalation or quarterly business reviews will fix them:

- You have raised the same issue three or more times without a lasting resolution. If your 3PL fixes problems reactively but never addresses the root cause, the issue is systemic.

- Your kitting or value-added work is consistently late or deprioritized. If simple pick-and-ship orders go out on time but kitted orders slip, your work is being treated as second-tier.

- You cannot get a direct conversation with someone who can make decisions. If every request goes into a queue and every decision requires multiple levels of approval, the organization is not built to serve your account.

- Your cost per unit has not decreased in twelve months or more. If you are at the same price point you were a year ago despite stable or growing volume, your 3PL is not investing in optimizing your operation.

- Peak season error rates are significantly higher than steady-state. If quality degrades during the periods when it matters most, the 3PL's operational model cannot handle your variability.

- Your internal team spends more time managing the 3PL than managing the business. If your Head of Operations is spending 40% of their week on 3PL communication, escalation, and oversight, the partnership is costing you far more than the invoice suggests.

As one VP of Operations at a global medical device manufacturer put it: what matters is knowing that if something goes wrong, one call can mobilize the resources to handle it. That responsiveness is not about vendor management—it is about structural readiness on the provider's side to solve problems when they arise.

What to Look for in a Replacement 3PL

If you have decided to switch, the question becomes: what should you look for to avoid ending up in the same situation with a different provider? The answer is not simply “a smaller 3PL.” Small providers often lack the capacity, technology, and geographic reach that your business requires. The goal is to find a partner that combines enterprise-level capability with the agility and accountability of a relationship-driven operation.

Process Engineering, Not Just Headcount

The best 3PLs do not simply throw labor at your operation. They engineer it. That means designing work cell layouts for optimal throughput, building quality checkpoints into the workflow rather than bolting them on at the end, and using data to identify improvement opportunities.

Ask how the 3PL designs a kitting process. If the answer is “we assign trained associates,” that is staffing. If the answer involves cycle time analysis, BOM management systems, and error tracking dashboards, that is engineering. At Productiv, we use lean-engineered workflows and real-time data capture to drive continuous improvement. For a paper goods client, this approach delivered 35% lower labor costs across 3 million cases and 300 unique SKUs annually.

Kitting as a Core Competency

Not all 3PLs treat kitting and assembly as core work. For many, it is an afterthought—a service they offer because clients ask for it, not because they have invested in the systems and processes to do it well. Look for a provider where kitting is a primary capability, not a secondary one. That means dedicated kitting areas, specialized operators, barcode verification systems, and a track record of handling high-SKU-count, variable-configuration work at volume.

Our work on an apparel reverse logistics project illustrates what this looks like in practice: 175,000 pieces of apparel across 50 SKUs needed sorting, tagging, and packaging for resale—with complex requirements that each carton contain exactly 24 pieces, a minimum of 1 of each size across 6 sizes, at least 4 styles, and no more than 5 of any single size. Our IT team wrote a custom sorting algorithm, and operations executed an assembly-line pick-and-pack process that produced 7,000+ finished cartons in two weeks at 100% spec compliance. A 3PL that treats kitting as an add-on simply cannot deliver that kind of engineered precision.

Direct Access to Leadership

One of the most consistent reasons brands leave large 3PLs is the inability to reach someone who can make decisions. When evaluating a new provider, ask who your day-to-day contact will be and what authority they have. Can they approve process changes without escalation? Can they allocate labor for a surge without a formal change order?

At Productiv, our structure is built around direct access—clients work with Paul and Doug, the people running the company, without layers of account managers in between. Jimmy Cullop, 3PL Manager at Orora Landsberg, described what that looks like in practice:

They're always treating us like a new customer whether its the first project or the 8th project. They come to the table with an open concept of ‘we're going to make it work’, whatever you need.

The best partnerships feel like an extension of your own operations team—not like a vendor relationship mediated by account managers and ticketing systems.

Flexible Deployment Models

Your fulfillment needs are not static, and your 3PL relationship should not be either. Look for a partner that offers multiple deployment models: a dedicated 3PL network for outsourced fulfillment, and embedded operations for situations where you need managed execution inside your own facility. The ability to flex between models as your business evolves prevents the lock-in that makes switching painful in the first place.

Retail Compliance Expertise

If you ship into major retailers—Walmart, Target, Sephora, Macy's, or similar—your 3PL must be fluent in EDI and retail compliance. That means routing guide compliance, labeling accuracy, ASN transmission, and the ability to pass retailer audits.

The IT integration speed matters more than most brands realize. Jeremy Lockhart, Director of Operations at Orora Landsberg, described their experience:

Productiv said it would take 3 days and the customer was like ‘wow, this usually takes us one to two months.’

That is not an outlier. We maintain pre-wired EDI connections and a UCC-128 label library for 60+ major retailers. When a new client onboards, we are not building compliance from scratch—we are activating connections that already exist. A missed compliance requirement does not just create a chargeback. It damages a relationship that took years to build. For a deeper look at how retail compliance setup prevents chargebacks, see our guide to preventing retail chargebacks.

Continuous Improvement Built into the Model

This is the single most important differentiator and the one most often missing from 3PL evaluations. Ask the prospective provider: how will my cost per unit change over the next twelve months? How do you track and reduce error rates? What does your improvement methodology look like?

A provider that cannot answer these questions concretely is offering you static performance—the same thing you are leaving. At Productiv, continuous improvement is not a slide in a sales deck. It is what our clients experience every quarter. Automation for packaging and picking, inventory cycle count automation, paperless procedures, real-time data capture, order consolidation to lower freight costs—these are the specific initiatives that drive cost per unit down over time.

How to Manage the Transition

The fear of disruption is what keeps many brands in underperforming 3PL relationships longer than they should be. A well-managed transition mitigates that risk. Here is how we have seen the most successful transitions work.

Phase the Migration

Do not move everything at once. Start with a single product line, a specific SKU segment, or a new promotional project. This lets you validate the new provider's capabilities on real work before committing full volume.

This is how most of our client relationships begin. One consumer goods company started as a small project with Productiv as a secondary vendor. Within 30 days, SLAs improved to 99%+ across on-time fulfillment, order accuracy, and inventory accuracy—with real-time SLA dashboards providing full transparency. Within three to six months, they had moved all of their work to us. That phased approach is low-risk and gives both sides a chance to build confidence.

Expect Fast IT Integration

One of the hidden costs of a 3PL transition is IT setup time. EDI connections, WMS integration, API links to your ecommerce platform—these can take months with providers that are building from scratch. Our typical onboarding includes EDI for retailers via SPS Commerce, API connections for wholesalers and DTC, and a connected WMS (Extensiv) integrated with your ERP (NetSuite and others). We have taken brands from program design to first orders in 12 weeks, with the design phase itself taking about 6 weeks of analyzing order, inventory, shipping, and SLA data to engineer the right operation.

Prioritize Retail Channel Coordination

If you are shipping into retail, coordinate the transition with your retail buyers. Update ship-from addresses, test EDI connections with the new provider, verify that B2B distribution complies with all routing guide requirements, and build safety stock to cover any delays during the changeover.

Evergreen Enterprises leveraged our geographic footprint—including Las Vegas and Dallas locations—to reduce parcel shipping zones from 6-8 down to 1-3, significantly reducing their annual parcel spend. The right geographic positioning turns a 3PL transition from a disruption into a cost-reduction opportunity.

Establish Baseline Metrics from Day One

Before you switch, document your current 3PL's performance: cost per unit, order accuracy, on-time shipment rate, error rate, and any other KPIs that matter to your business. These become the baseline against which you measure the new provider. A good 3PL will welcome this—it gives them a target to beat and a framework for demonstrating improvement.

Safeguard Medical shifted operations to our North Carolina location. Their Sr. Manufacturing Engineering Manager, Pinal Patel, described what a well-run transition looks like after the switch is complete:

When we set the process, it just works. We send in the material. It gets packed out, turned around to us. So there's minimal interaction that we have to do.

Minimal issues over the life of the relationship. That is what a 3PL relationship should look like once the transition is behind you—the operation runs, you focus on your business, and the 3PL handles the rest.

The Cost of Staying Too Long

The numbers behind staying are sobering. According to industry analysis, a warehouse processing 500,000 orders annually at a 97% accuracy rate—which sounds acceptable—is generating 15,000 mispicked orders per year, costing between $705,000 and $1.4 million in hard costs alone. Improving to 99.5% accuracy would recover over a million dollars annually. The gap between “good enough” and “optimized” is measured in real dollars.

Brands often focus on the cost and risk of switching without accounting for the cost of staying. Static performance is not free—it compounds. Every month of suboptimal cost per unit, every peak season with elevated error rates, every hour your operations team spends managing the 3PL instead of growing the business is a cost. Over twelve months, a 3PL that charges 15% more per unit than an optimized operation on 500,000 units is not just more expensive—it is materially limiting your margin and your ability to invest in growth.

There is also an opportunity cost that rarely appears on a spreadsheet. When your operations team is spending its time managing 3PL escalations, auditing shipments for errors, and reworking kitting schedules that slipped, that team is not working on growth initiatives, new product launches, or retail expansion. The 3PL relationship that was originally supposed to free up your operational bandwidth is actively consuming it instead.

The brands that make the switch most successfully are the ones that quantify this cost honestly, compare it to the one-time disruption of a transition, and recognize that the math overwhelmingly favors moving to a dedicated partner that will improve over time.

What Enterprise Capability Without Enterprise Bureaucracy Looks Like

The phrase that surfaces most often when brands describe what they want in a 3PL—after leaving a large one—is some variation of “enterprise capability without enterprise bureaucracy.” They want the capacity, the national reach, the technology, and the compliance expertise of a major provider. But they also want direct access to leadership, responsive communication, custom process engineering, and a partner that treats their account as a relationship rather than a contract.

At Productiv, this is the operating model we have built over two decades. We deliver kitting and assembly, DTC fulfillment, B2B distribution, contract packaging, and retail compliance through engineered operations that improve over time. The proof is in the outcomes our clients have experienced:

- 99%+ SLA performance within 30 days of onboarding for a consumer goods company that had been struggling with late and mis-shipped orders.

- 5,000 to 25,000 units per shift within six months for a national cosmetics brand, with output data now used as the company's annual production standard.

- 35% reduction in labor costs across 3 million cases for a paper goods repackaging operation.

- 175,000 apparel items sorted into 7,000+ finished cartons in two weeks at 100% spec compliance.

- 5x business growth for Sonopress in their first year of partnership, enabled by one-to-two-day labor ramp capability.

- IT integration in 2–4 weeks versus the 2–4 months clients experienced with previous providers.

We operate through two deployment models: a nationwide 3PL warehouse network and embedded operations inside your facility. Whether you need a full-service outsourced fulfillment partner or a managed team running production lines in your own plant, the approach is the same: process engineering, trained operators, quality systems, real-time transparency, and improvement cycles that are built into every engagement—not added as an afterthought.

Steve Ballard, CEO of Ballard Brands, put it simply:

Productiv's customer service is the best I have ever seen, and their leadership in our project made everyone's role easier.

If you are evaluating whether to stay with your current 3PL or make a change, start a conversation with our team. We will walk through your current operation, identify where you are leaving value on the table, and show you what a 3PL relationship that actually improves over time looks like in practice.

Paul Baker

CFO, Productiv

Paul co-leads Productiv alongside Doug Legan, bringing two decades of hands-on experience in 3PL operations, kitting, fulfillment, and embedded manufacturing. Clients reference Paul by name when describing the direct leadership access that sets Productiv apart from enterprise providers. Paul is leading Productiv's push into AI and robotics to give Productiv's clients the greatest competitive advantage against their competitors as we enter the age of AI.

Frequently Asked Questions About Switching 3PLs

How do I know it's time to switch 3PL providers?

The clearest signals are repeated missed SLAs with no improvement plan, kitting or value-added work being deprioritized in favor of simpler fulfillment, communication that requires multiple escalations to get a response, and an inability to scale for seasonal or promotional surges without quality degradation. If your 3PL treats your account as a static contract rather than a relationship that should improve over time, that's the most telling sign.

What's the biggest risk when switching 3PLs?

The biggest risk is a gap in fulfillment during the transition. This is why the best transitions are phased — starting with a single product line, SKU segment, or project before migrating full volume. A good incoming 3PL will build a detailed transition plan with parallel running periods, inventory reconciliation checkpoints, and clear go/no-go criteria before cutover. We've transitioned brands from enterprise providers to first shipments in as little as 12 weeks for complex kitting operations.

How long does a 3PL transition typically take?

For straightforward fulfillment, 4–8 weeks from contract to first shipments. For complex kitting operations with retail compliance requirements, plan for 6–12 weeks to allow for process engineering, quality system setup, and retailer approval of new shipping origins. In our experience, the design phase takes about 6 weeks (analyzing your order, inventory, shipping, and SLA data), followed by a 12-week onboarding to first orders — including IT integrations like EDI for retailers and API connections to your ecommerce platform.

Can I switch 3PLs without disrupting my retail relationships?

Yes, but it requires planning. Notify retail buyers of the new shipping origin, update EDI connections, ensure the new provider meets all routing guide requirements from day one, and maintain safety stock during the transition. Brands that switch to a provider with existing retail compliance expertise — we ship to 60+ major retailers with a pre-built UCC-128 label library and pre-wired ASN connections — minimize the risk of chargebacks or late shipments during the changeover.

What should I look for in a 3PL if I'm leaving a large provider?

Look for enterprise-level capability without enterprise bureaucracy: the ability to handle your volume and complexity, but with direct access to leadership, responsive communication, and willingness to engineer custom solutions for your operation. Evaluate how they handle kitting and value-added work specifically — not just storage and shipping. Ask for their improvement methodology: how do they reduce cost per unit and error rates over time? And critically, ask about their IT setup time — at Productiv, we've set up full integrations in 2–4 weeks that clients say typically take 2–4 months with other providers.

Is it worth switching if my current 3PL is 'good enough'?

That depends on whether 'good enough' is costing you more than you realize. Static performance means your cost per unit never decreases, errors plateau instead of declining, and you absorb the inefficiency as a fixed cost of doing business. We've seen clients achieve 35% reductions in labor costs, 10-point efficiency upticks on shift performance, and cost-per-unit decreases that compound quarter over quarter — value that 'good enough' leaves entirely on the table.

What is fixed unit cost pricing in 3PL, and why does it matter?

Fixed unit cost pricing means you pay a set rate per unit processed rather than paying for labor hours, warehouse space, and overhead separately. The key advantage is incentive alignment: the 3PL earns more by working more efficiently, which creates a built-in motivation to engineer improvements into your operation rather than just maintaining the status quo. In a traditional cost-plus model, the 3PL has no structural reason to reduce your costs — they may even earn less if they become more efficient. With fixed unit cost, both sides benefit when throughput improves and error rates decline.

How do I evaluate a 3PL's kitting and assembly capabilities?

Ask how they design a kitting process — not just who will do the work. If the answer is 'we assign trained associates,' that's staffing. If the answer involves cycle time analysis, BOM management systems, work cell layout design, and error tracking dashboards, that's process engineering. Look for dedicated kitting areas with barcode verification, a track record with high-SKU-count variable-configuration work, and specific examples of how they've handled complexity. We've run operations ranging from subscription box builds with monthly variation to custom surgical procedure tray kitting with strict compliance requirements — each engineered differently because kitting is our core competency, not an add-on.

Can a 3PL handle both DTC fulfillment and retail distribution?

Yes, but most 3PLs are optimized for one or the other. DTC requires high-volume small-parcel shipping, custom packaging, and fast turnaround. Retail distribution (B2B) requires routing guide compliance, EDI integration, ASN transmission, and retailer-specific labeling. A provider that handles both under one roof eliminates the need to split your operation across multiple 3PLs — which is exactly the situation that drives many brands to consolidate. We've onboarded clients who were using two separate providers just to cover hand packaging requirements while hitting retail OTIF SLAs, and consolidated everything into a single operation.

What's the difference between a 3PL warehouse and embedded operations?

A 3PL warehouse is an outsourced facility where the provider manages your inventory, fulfillment, and shipping from their own location. Embedded operations means the provider places a managed team inside your facility — running production lines, kitting stations, or warehouse operations within your own plant. The advantage of embedded is that it gives you flexible, managed labor capacity without the overhead of hiring, training, and managing a permanent workforce. Some brands start with one model and shift to the other as their needs change, which is why working with a provider that offers both deployment models prevents lock-in.

How should I handle inventory during a 3PL transition?

Build safety stock before the transition to cover any gaps during cutover. The most successful transitions we've managed use a phased approach: start by sending new production runs or a single product line to the new provider while your existing 3PL continues to ship current inventory. This parallel running period — typically 4 to 8 weeks — lets you validate accuracy, verify IT integrations, and confirm retailer compliance before committing full volume. Conduct inventory reconciliation at defined checkpoints throughout the transition, and establish clear go/no-go criteria before each phase of the cutover.

What IT integrations should I expect from a modern 3PL?

At minimum, your 3PL should support EDI connections for retail customers (including UCC-128 labeling and ASN transmission), API integration for your ecommerce platform and wholesale channels, and a connected warehouse management system (WMS) that syncs with your ERP. The speed of integration matters: providers that maintain pre-built connections can get you operational in weeks, while those building from scratch may take months. We maintain pre-wired EDI connections and label libraries for 60+ major retailers through SPS Commerce, API connections for DTC and wholesale channels, and WMS integration through Extensiv that connects with ERPs like NetSuite.

How do I know if my 3PL can handle seasonal or promotional surges?

Ask for specific examples of how they've scaled — not just whether they can. Key questions: What's the fastest you've ramped labor for a client? How many additional production lines can you add? What happens to quality metrics during peak periods? If error rates spike during surges, the provider's model can't handle your variability. We've ramped from zero to 27 production lines for a cosmetics brand, scaled to support 5x business growth for a manufacturing partner in a single year, and provided surge capacity with as little as one to two days of lead time.

What is continuous improvement in 3PL operations, and how is it measured?

Continuous improvement means your operation gets better over time — lower cost per unit, fewer errors, higher throughput — rather than staying static year after year. It's measured through specific KPIs tracked over rolling periods: cost per unit trend, order accuracy rate, on-time shipment rate, and throughput per shift. Ask prospective providers what their improvement methodology looks like and how your costs will change over the next twelve months. If they can't answer concretely, they're offering static performance. Specific improvement initiatives include automation for packaging and picking, inventory cycle count automation, paperless procedures, real-time data capture, and order consolidation to reduce freight costs.

How do smaller brands with lean operations teams choose the right 3PL?

Brands with small headquarters teams — often just a Head of Operations plus a few support staff — need a 3PL that acts as an extension of their operations, not a vendor they have to manage. The biggest mistake is choosing a provider based solely on price or capacity without evaluating communication structure and responsiveness. If every request becomes a ticket in a queue and every change requires multiple approvals, your lean team will spend more time managing the 3PL than managing the business. Look for direct access to decision-makers, proactive communication, and a partner that can handle complexity without requiring constant oversight.

What questions should I ask during a 3PL evaluation or RFP?

Beyond pricing and capacity, focus on these areas: How do you design a kitting or fulfillment process — is it engineered or just staffed? Who will I communicate with day-to-day, and what authority do they have to make decisions? How will my cost per unit change over the next twelve months? What does your IT integration timeline look like? How do you handle surge demand — can you show me a specific example? What's your retail compliance setup for my specific retail customers? And critically: how do you measure and report on your own performance? A provider that can answer these with specifics rather than generalities is one that has invested in the systems and processes to back up their claims.

What role does geographic footprint play in 3PL selection?

Geographic positioning directly impacts shipping costs and delivery speed. A 3PL with strategically located facilities can reduce parcel shipping zones — for example, shipping from Las Vegas and Dallas can reduce zones from 6-8 down to 1-3 for many destinations, significantly cutting parcel costs. Multiple locations also provide redundancy: if one facility hits capacity or is affected by a disruption, volume can shift to another location without interrupting service. When evaluating a 3PL's geographic footprint, consider where your customers are concentrated and how the provider's locations align with those zones.

How do 3PLs handle retail compliance requirements like EDI, routing guides, and OTIF?

Retail compliance involves meeting each retailer's specific requirements for labeling (UCC-128), electronic data interchange (EDI) for purchase orders and advance ship notices (ASNs), routing guide compliance for how shipments are packed and transported, and on-time in-full (OTIF) delivery metrics. A missed compliance requirement doesn't just create a chargeback — it damages a retailer relationship that took years to build. The best 3PLs maintain pre-built connections and label libraries for major retailers so that compliance is activated rather than built from scratch during onboarding. Ask how many retail customers the 3PL currently ships to and whether they have existing EDI connections with your specific retailers.

Related Services

Enterprise Capability. Small-Company Agility.

Ready to Find a 3PL That Actually Improves?

Talk to our team about what a 3PL partnership built around continuous improvement looks like—not just storage and shipping.

Start a Conversation